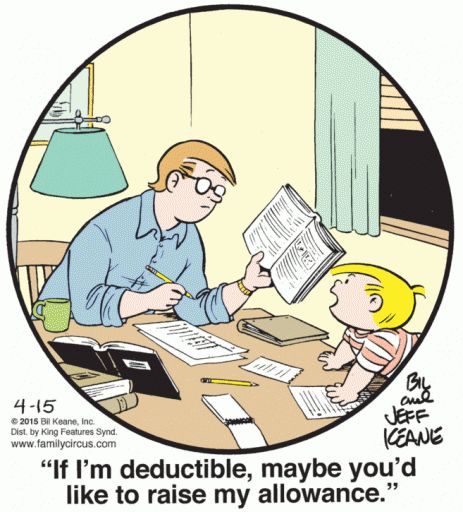

The End of Tax Season is Upon Us...

Have you collected all your documents to file your return? It’s that time again and we have updated our Tax Return Form so that you don’s miss any documents which could get you a bigger refund.

Please ensure to get all your documents to us by April 23rd!

A lot of people cringe at these few words…. Income Tax time… but it’s important to understand how it all works and why we need it.

The Purpose of Income Tax

The federal government uses income tax to fund a range of services and projects. It uses it for everything, from health care, to infrastructure projects such as roads and bridges, to paying for the military, to covering the pay cheques of politicians or civilian servants.

In addition, provinces and territories also collect income tax return. The amount they collect varies, as they also set different income tax rates, but they also use the money for the public good.

Without Income tax, the government would not be able to operate.

Below are some changes (credits and deductions that have been introduced or eliminated; doesn't include any changes to tax rates or tax brackets) which may impact how you file your taxes:

Federal

The federal public transit amount has been eliminated.

The employee home relocation loans deduction has been eliminated.

The first time donor's super credit has been eliminated.

The "tax on split income" (TOSI) rules now apply to certain adults who earn income from related businesses. Learn more.

Ontario

The Climate Action Incentive is a new, refundable credit for residents of certain provinces (including Ontario). Most people can claim this credit.

Ontario tuition and education amounts (and transfers) have been eliminated. However, you can still claim any unused provincial amounts from prior years

If you are unsure about what you need to get started or if you get stuck in the process, do not hesitate to call us with any questions or comments!